There are various benefits of using Mollie as your preferred payment gateway which are as follows:

Easy Setup - Creating, verifying and activating a Mollie account is an easy, convenient and time-efficient process.

Transparent Pricing - The cost structure for Mollie will only ask your customers to pay for transactions that have been successfully executed. Also, Mollie does not have any hidden costs, monthly fees or fixed contracts and does not have a minimum cost requirement.

Recurring Payments - Mollie provides the feature of recurring payments so that automated payments can be made periodically without your customers having to go through the hassle of doing it themselves.

Secure Provider - Mollie ensures that all payments are transferred on a secure network so that no unauthorized user can have any unauthenticated access. Moreover, Mollie is PCI-DSS level 1 certified, ensuring that all transactions are securely executed.

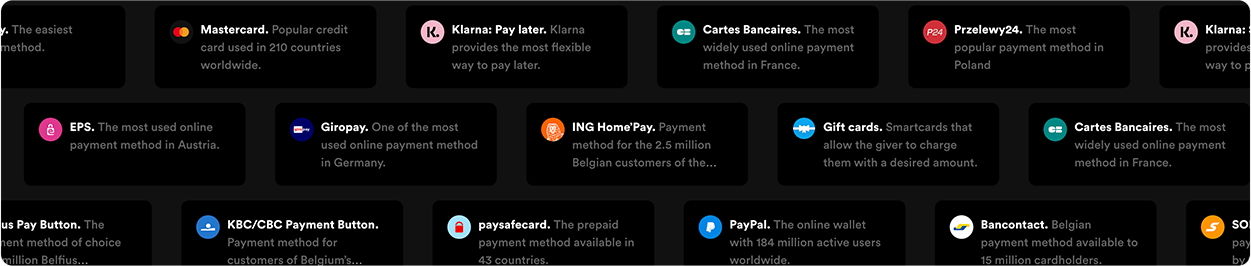

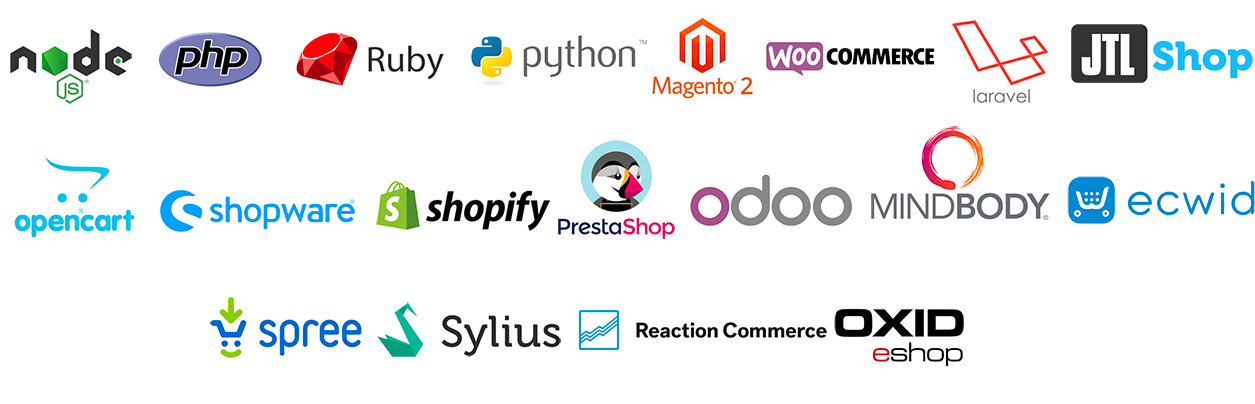

Easy Integratable - Mollie can easily be integrated into any ecommerce website and is compatible with a lot of local, regional and global payment tools and providers. Moreover, Mollie is always on the lookout to add new payment methods.

Streamlined Checkout - Possibly one of the biggest advantages of Mollie is that instead of navigating your customers to another page for making a payment, they can choose their preferred mode of payment and carry out the payment within the same website.

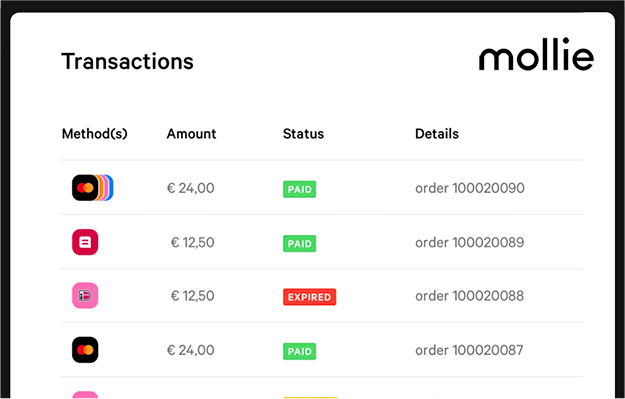

Dashboard - The Mollie dashboard provides you with all your payment information in a single place and can be seamlessly integrated with all kinds of accounting software.

Multi Currency - With Mollie, instead of having to make payments in popular currencies like dollars, pounds or euros, you can make payments in your preferred currency.

User Friendly - Mollie is user friendly with an interactive and device-friendly interface which can be easily used on multiple different devices.